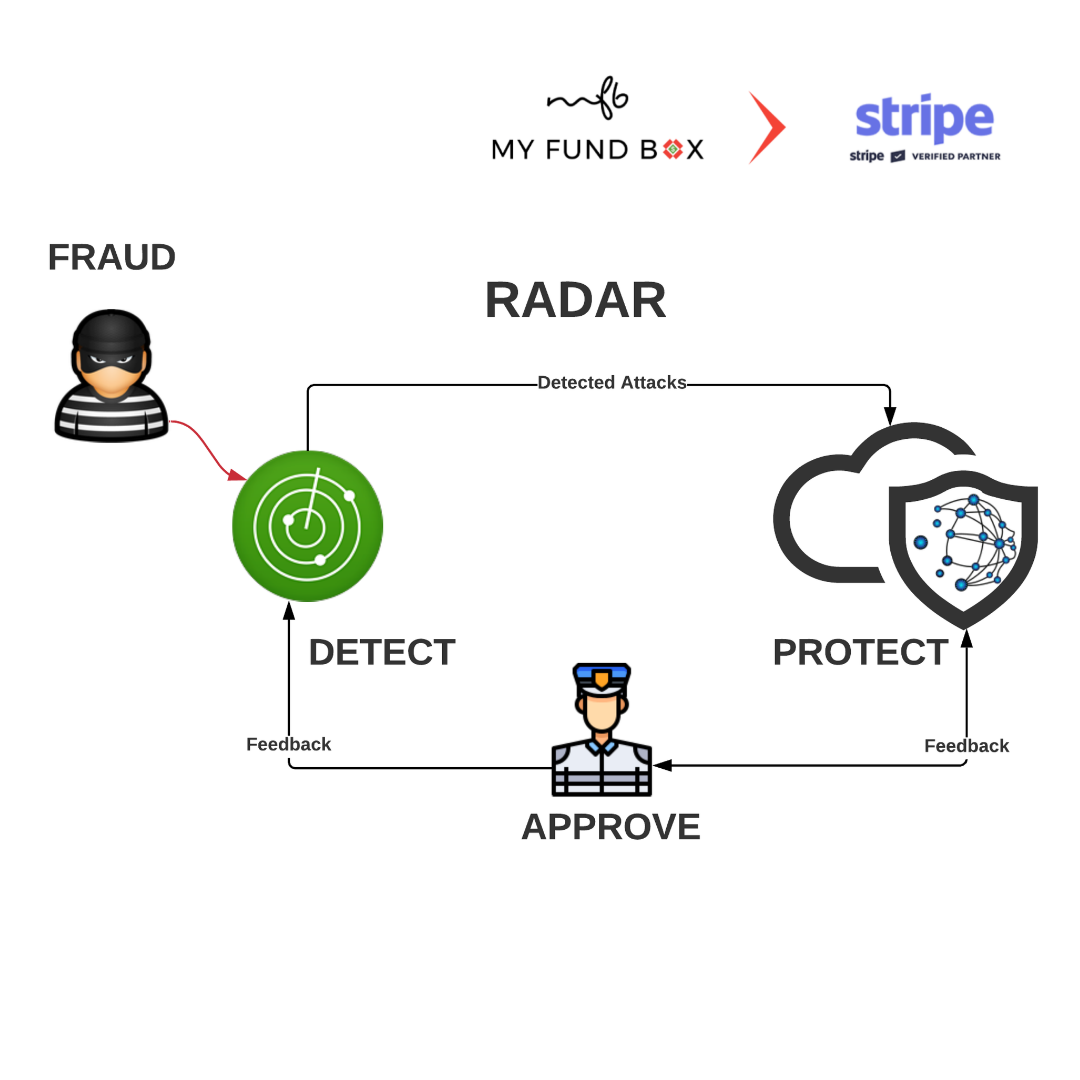

Smart fraud detection with MYFUNDBOX and Stripe Radar

Fraud costs merchants more than an estimated $20 billion every year. But beyond that sky-high number are all the ancillary impacts that fraud can have on a business: increased customer churn, lower credit card authorization rates, network and operational costs, and damage to the brand due to customers being incorrectly flagged as fraudsters. To stay competitive, businesses need to detect fraud without compromising customer experience, and use modern strategies to detect, flag, and resolve fraud in real-time.