Top 5 Ways Automated Billing Can Improve Cash Flow in Your SaaS Business

Dream big.

Posts about:

Dream big.

.png)

“A goal without a plan is just a wish.” ― Antoine de Saint-Exupéry.

.jpg)

The SaaS industry is skyrocketing!

.jpg)

Time flies! They say.

Customer expectations are changing rapidly, and what people learn to love in one industry increasingly defines what they expect in other industries as well. These ever-shifting expectations put pressure on businesses to meet their customers where they are – delivering their products faster, cheaper and more seamlessly than ever.

At any stage in a company's journey, revenue is a critical data point. It's a key performance indicator necessary for smart decision-making and keeping your business on track. But as your business grows, accounting often becomes a bigger headache.

For many businesses, tracking revenue is a complicated and labour-intensive chore. Factor in different scenarios such as subscription billing, upgrades, refunds and prorations, and the numbers become even more difficult to parse. And as accounting becomes more complex, it's also more prone to errors – which can add up to more time and expense.

.jpg)

What is it that unites ecommerce across size, industry, business model, and geography? The answer, unfortunately, is fraud.

Are you looking for a way to keep track of your customers and their subscriptions? Then you need a subscription management system. Read on to learn about the benefits of using one!

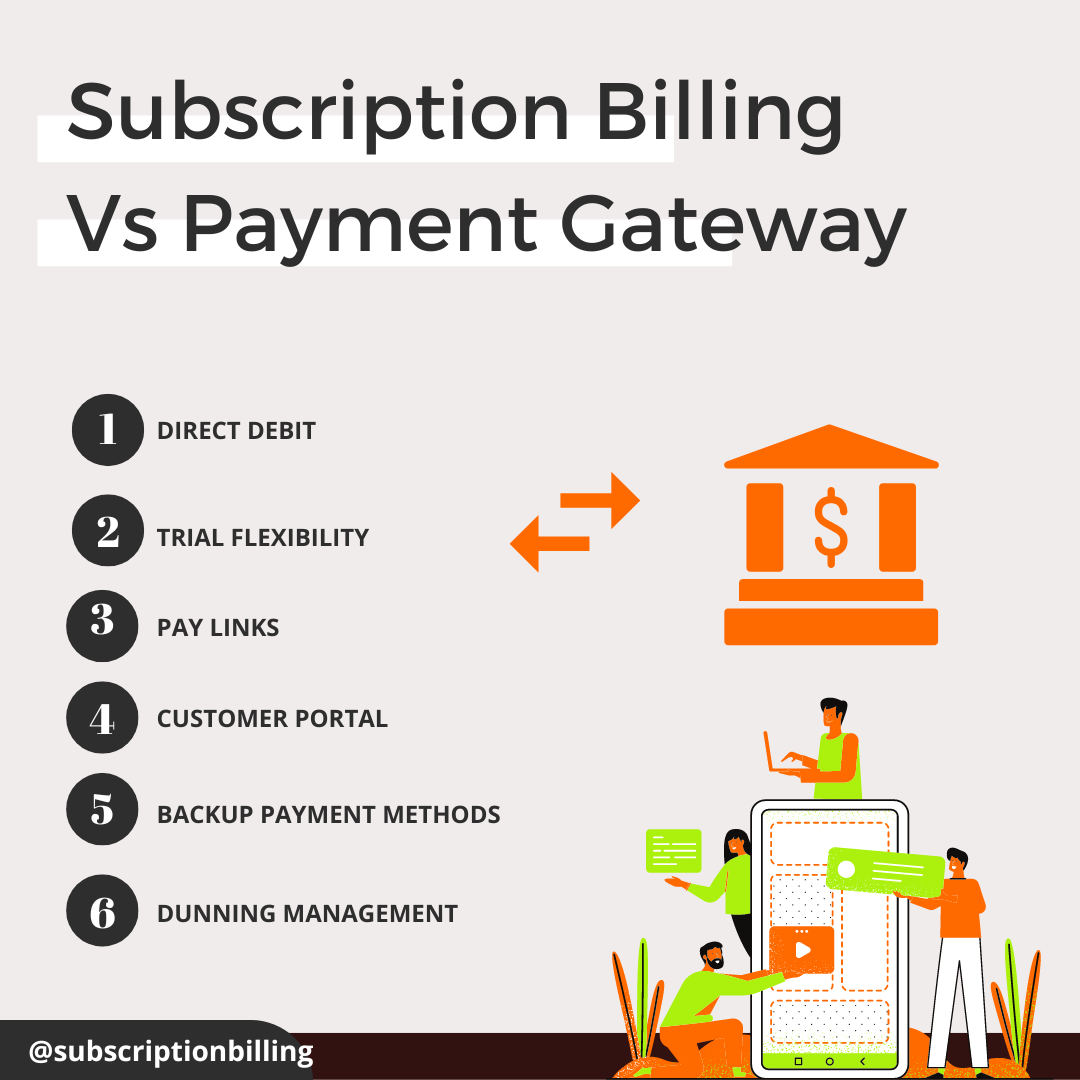

when it comes to a choice between a #subscriptionbilling platform and a #paymentgateway. Customer experience is of foremost importance for any business, and this only gets amplified for a SaaS or subscription business, where concerns like #churn and #customerretention take the foreground.

How you accept payments from your customers probably isn’t an area you spent a lot of time researching. But businesses that don’t optimise their method of accepting payment commonly create these ongoing problems for themselves: