The benefits of integrating a payment gateway for small businesses

“The advance of technology is based on making it fit in so that you don't really even notice it, so it's part of everyday life.”

Bill Gates, Co-founder of Microsoft.

Posts about:

“The advance of technology is based on making it fit in so that you don't really even notice it, so it's part of everyday life.”

Bill Gates, Co-founder of Microsoft.

A loyal and retained customer will act as an ambassador of your brand and product, and provide recurring cash flow to your business. Bringing New customers is not only an effort taking but promising job as well. It is not about selling a product, it is about gaining customers. When the matured customers are happy, it’s easier to attract new ones.

Since 2021, MYFUNDBOX a bootstrapped Start-up, has been offering a Subscription Billing Platform for all business that rely on recurring payments and Subscriptions.

Are you looking for a way to keep track of your customers and their subscriptions? Then you need a subscription management system. Read on to learn about the benefits of using one!

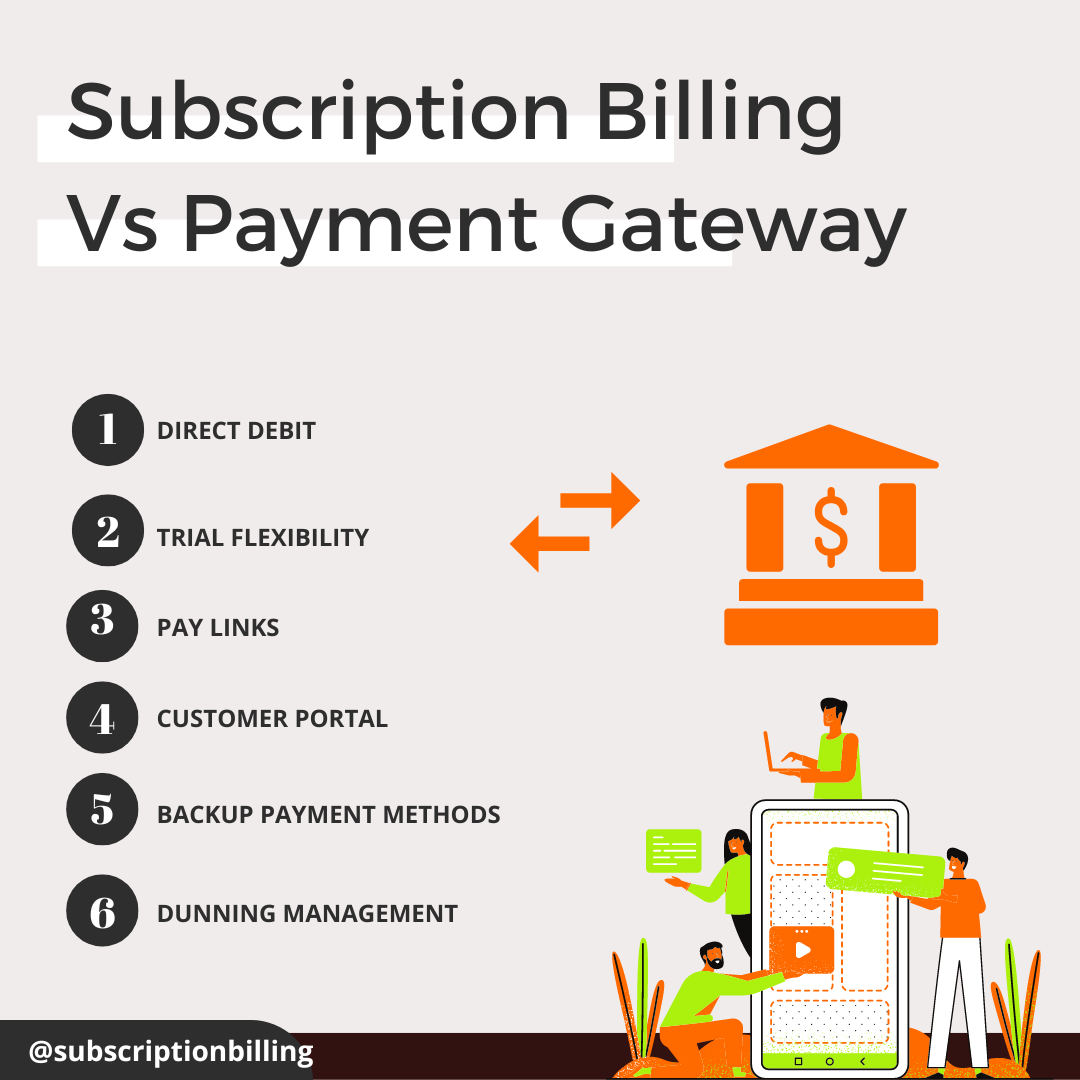

when it comes to a choice between a #subscriptionbilling platform and a #paymentgateway. Customer experience is of foremost importance for any business, and this only gets amplified for a SaaS or subscription business, where concerns like #churn and #customerretention take the foreground.

How you accept payments from your customers probably isn’t an area you spent a lot of time researching. But businesses that don’t optimise their method of accepting payment commonly create these ongoing problems for themselves:

The trend toward #subscription-based business is clear: by 2023, 75% of direct-to-consumer #ecommerce brands are expected to adopt a subscription model.

Adopting a subscription-based model is a proven way for ecommerce businesses to capture more repeat business, add new revenue streams, and grow their market share.

As more and more enterprise businesses move toward a SaaS or recurring service model, they need a billing solution that can manage recurring invoices and payments. But that’s not all—they also need a solution that can save time and resources, reduce accounting and reporting errors, and handle compliance and tax across multiple markets as the business grows.

Operating on a subscription-based model is proven to help startups go to market faster and enjoy greater flexibility. For all smaller businesses, it’s also a way to acquire repeat customers, add new revenue streams, and grow market share. However, because recurring payments require a different approach to billing than one-time purchases, launching this type of business isn’t always as simple as deciding to do it.