Part-II Why do you need Google Cloud and MYFUNDBOX?

In today's rapidly developing world of subscription business, storing, accessing and maintaining 'BIG DATA' is a task in itself.

Posts about:

In today's rapidly developing world of subscription business, storing, accessing and maintaining 'BIG DATA' is a task in itself.

The trend toward #subscription-based business is clear: by 2023, 75% of direct-to-consumer #ecommerce brands are expected to adopt a subscription model.

Adopting a subscription-based model is a proven way for ecommerce businesses to capture more repeat business, add new revenue streams, and grow their market share.

As more and more enterprise businesses move toward a SaaS or recurring service model, they need a billing solution that can manage recurring invoices and payments. But that’s not all—they also need a solution that can save time and resources, reduce accounting and reporting errors, and handle compliance and tax across multiple markets as the business grows.

Operating on a subscription-based model is proven to help startups go to market faster and enjoy greater flexibility. For all smaller businesses, it’s also a way to acquire repeat customers, add new revenue streams, and grow market share. However, because recurring payments require a different approach to billing than one-time purchases, launching this type of business isn’t always as simple as deciding to do it.

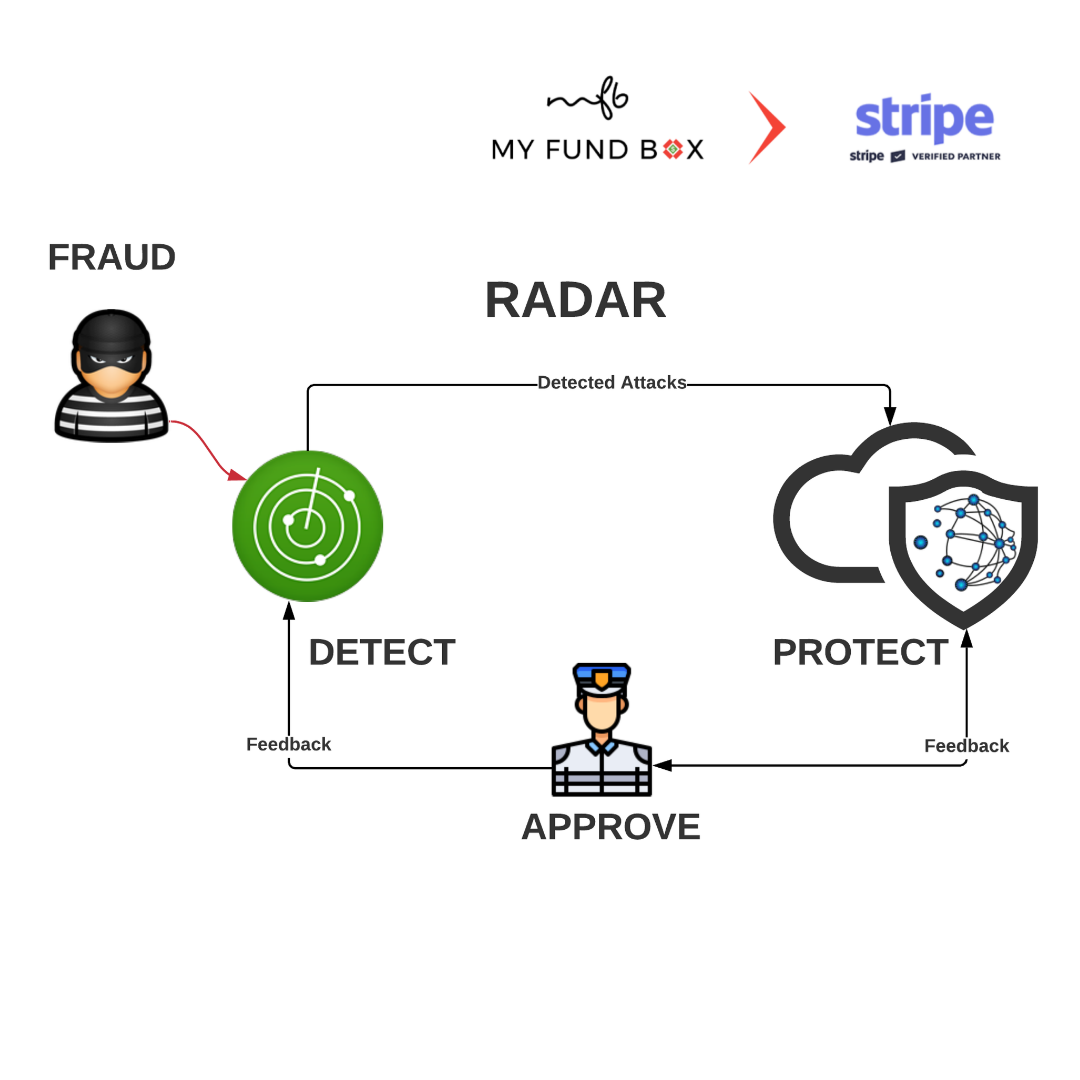

Fraud costs merchants more than an estimated $20 billion every year. But beyond that sky-high number are all the ancillary impacts that fraud can have on a business: increased customer churn, lower credit card authorization rates, network and operational costs, and damage to the brand due to customers being incorrectly flagged as fraudsters. To stay competitive, businesses need to detect fraud without compromising customer experience, and use modern strategies to detect, flag, and resolve fraud in real-time.

Even with the massive growth in #ecommerce, more than 90% of purchases still happen in person. Because of this, numerous businesses have recently expanded their solutions to include in-person payments. But while accepting in-person payments opens up vast opportunities, it also comes with its own set of challenges, including the need to integrate #online and #offline payment systems, and more.