Turning one-time payments into recurring revenue

Adopting a subscription-based model is a proven way for ecommerce businesses to capture more repeat business, add new revenue streams, and grow their market share.

Posts about:

Adopting a subscription-based model is a proven way for ecommerce businesses to capture more repeat business, add new revenue streams, and grow their market share.

To keep your business running smoothly and provide optimal experiences to your customers, you need a way to send invoices and collect payments that won’t frustrate them—or you. That’s especially true if they’re among the 40% of companies that still mail paper checks, creating more manual work for your customers and slowing down the process.

As more and more enterprise businesses move toward a SaaS or recurring service model, they need a billing solution that can manage recurring invoices and payments. But that’s not all—they also need a solution that can save time and resources, reduce accounting and reporting errors, and handle compliance and tax across multiple markets as the business grows.

Operating on a subscription-based model is proven to help startups go to market faster and enjoy greater flexibility. For all smaller businesses, it’s also a way to acquire repeat customers, add new revenue streams, and grow market share. However, because recurring payments require a different approach to billing than one-time purchases, launching this type of business isn’t always as simple as deciding to do it.

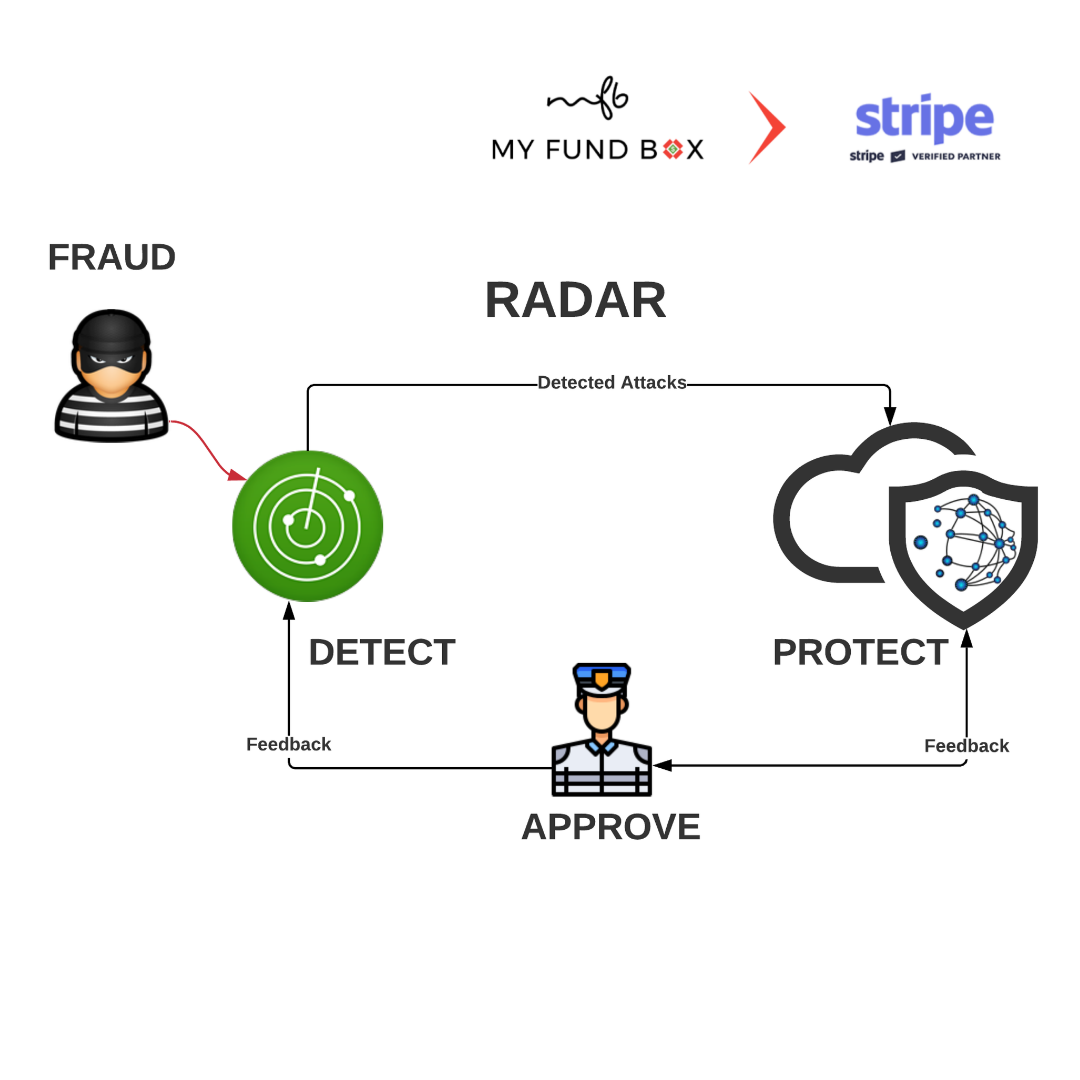

Fraud costs merchants more than an estimated $20 billion every year. But beyond that sky-high number are all the ancillary impacts that fraud can have on a business: increased customer churn, lower credit card authorization rates, network and operational costs, and damage to the brand due to customers being incorrectly flagged as fraudsters. To stay competitive, businesses need to detect fraud without compromising customer experience, and use modern strategies to detect, flag, and resolve fraud in real-time.

Even with the massive growth in #ecommerce, more than 90% of purchases still happen in person. Because of this, numerous businesses have recently expanded their solutions to include in-person payments. But while accepting in-person payments opens up vast opportunities, it also comes with its own set of challenges, including the need to integrate #online and #offline payment systems, and more.

As more businesses migrate online, MYFUNDBOX Subscription billing is continuously expanding our own solutions to make it simpler for our customers to future-proof their brands through shifting business models, global expansion and investments in new technology.

In recent years, the ecommerce industry has experienced unprecedented growth—and it continues to grow: Worldwide retail ecommerce sales, having grown more than 25 percent in 2020, are projected to climb another 16.8% in 2021. That's a tremendous opportunity for the enterprises poised to grab it. As more businesses migrate online, we're continuously expanding our own solutions to make it simpler for our customers to future-proof their brands through shifting business models, global expansion, and investments in new technology.

As more businesses migrate online, MYFUNDBOX is continuously expanding our own solutions to make it simpler for our customers to make the leap to digital, shift their business models, and start accepting online payments right away.

Rapid growth in ecommerce sales and digital adoption across the globe opens up a world of opportunity for businesses looking to expand. The numbers alone make a compelling case: in 2021, ecommerce sales are expected to make up nearly 20% of total retail volume.1 By 2023, global ecommerce is projected to hit $6.5 trillion2 with the majority of retail ecommerce growth occurring in Latin America, Central and Eastern Europe, and the Middle East and Africa.3