MYFUNDBOX – Global Subscription Billing Platform

Since 2021, MYFUNDBOX a bootstrapped Start-up, has been offering a Subscription Billing Platform for all business that rely on recurring payments and Subscriptions.

Posts about:

Since 2021, MYFUNDBOX a bootstrapped Start-up, has been offering a Subscription Billing Platform for all business that rely on recurring payments and Subscriptions.

Are you looking for a way to keep track of your customers and their subscriptions? Then you need a subscription management system. Read on to learn about the benefits of using one!

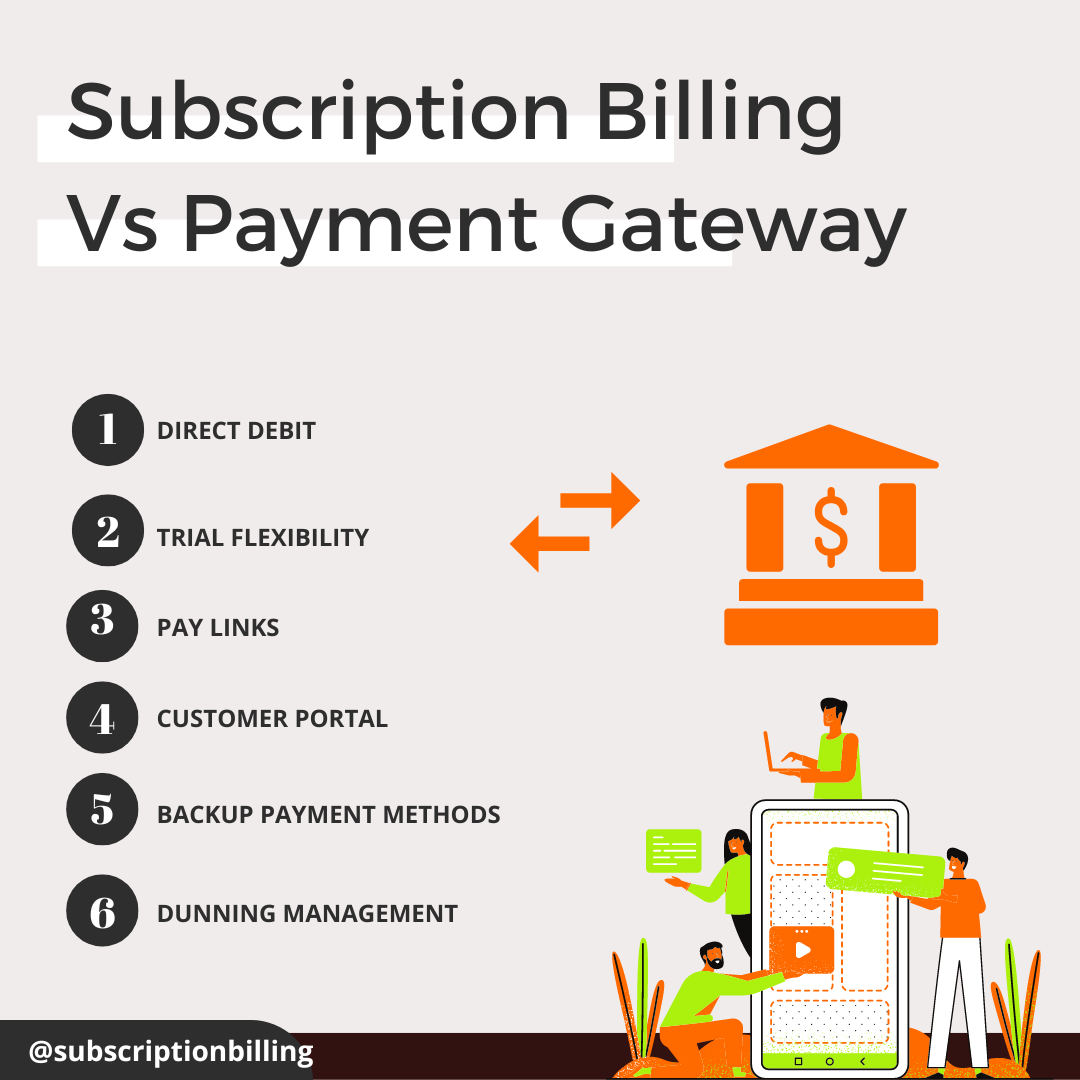

when it comes to a choice between a #subscriptionbilling platform and a #paymentgateway. Customer experience is of foremost importance for any business, and this only gets amplified for a SaaS or subscription business, where concerns like #churn and #customerretention take the foreground.

How you accept payments from your customers probably isn’t an area you spent a lot of time researching. But businesses that don’t optimise their method of accepting payment commonly create these ongoing problems for themselves:

Does your checkout need a checkup? For nearly all ecommerce businesses, the answer is an emphatic yes, according to MYFUNDBOX Subscription Billing’s global payments platform, Stripe. In a recent study that surveyed leading B2B and B2C ecommerce sites and customers, Stripe discovered that 96% of sites in North America, as well as 95% in Asia-Pacific and 94% in Europe, had at least five basic errors in their checkouts. The problem not only spans regions, but also organizations of all sizes, from startups to large, established ecommerce sites with teams focused on increasing conversions.

The trend toward #subscription-based business is clear: by 2023, 75% of direct-to-consumer #ecommerce brands are expected to adopt a subscription model.

To keep your business running smoothly and provide optimal experiences to your customers, you need a way to send invoices and collect payments that won’t frustrate them—or you. That’s especially true if they’re among the 40% of companies that still mail paper checks, creating more manual work for your customers and slowing down the process.

As more and more enterprise businesses move toward a SaaS or recurring service model, they need a billing solution that can manage recurring invoices and payments. But that’s not all—they also need a solution that can save time and resources, reduce accounting and reporting errors, and handle compliance and tax across multiple markets as the business grows.

Operating on a subscription-based model is proven to help startups go to market faster and enjoy greater flexibility. For all smaller businesses, it’s also a way to acquire repeat customers, add new revenue streams, and grow market share. However, because recurring payments require a different approach to billing than one-time purchases, launching this type of business isn’t always as simple as deciding to do it.

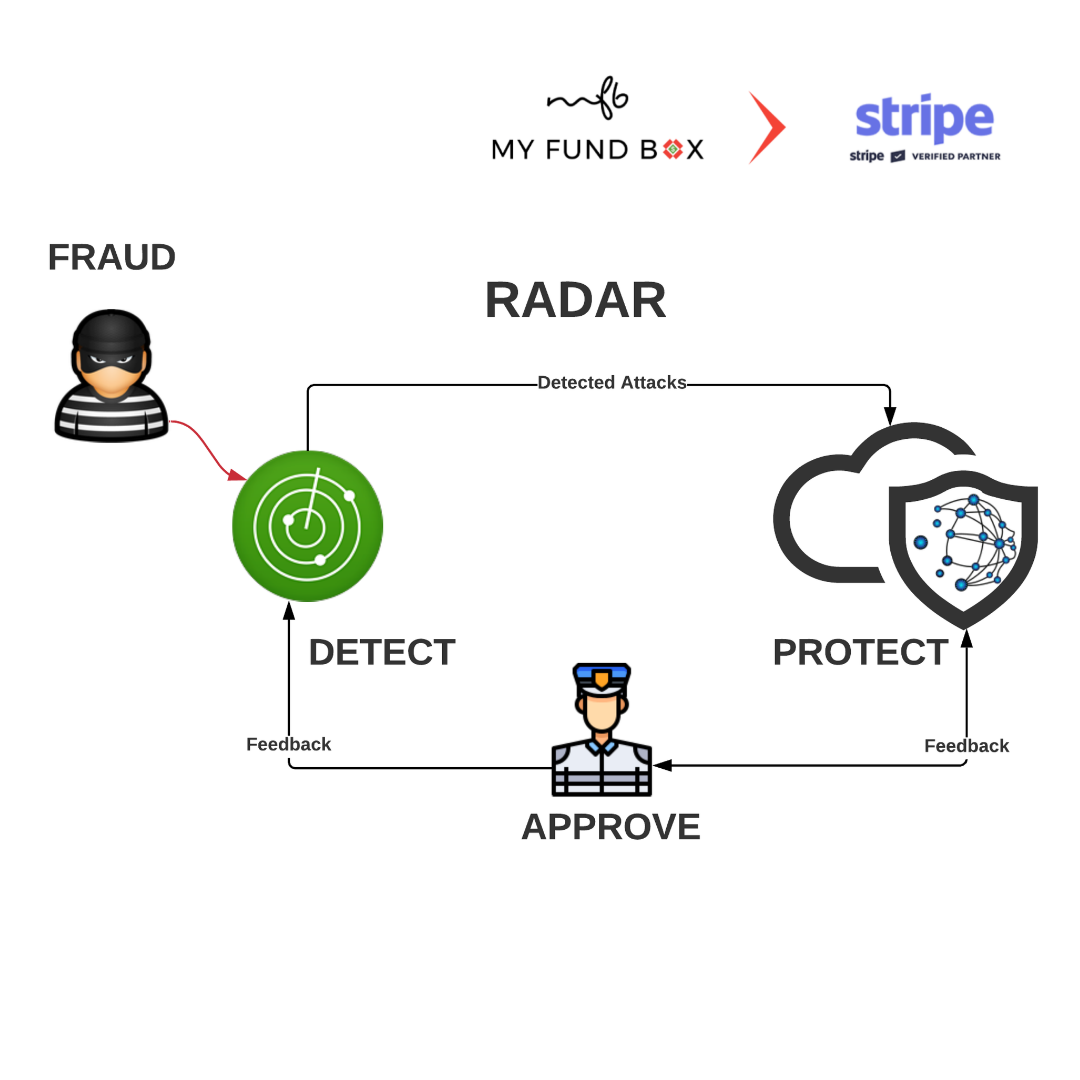

Fraud costs merchants more than an estimated $20 billion every year. But beyond that sky-high number are all the ancillary impacts that fraud can have on a business: increased customer churn, lower credit card authorization rates, network and operational costs, and damage to the brand due to customers being incorrectly flagged as fraudsters. To stay competitive, businesses need to detect fraud without compromising customer experience, and use modern strategies to detect, flag, and resolve fraud in real-time.