How critical is Churn rate?

Ever walked out of a shop empty handed due to the vendor taking his own sweet time to attend you or the pricing is higher than it is worth?

Posts about:

Ever walked out of a shop empty handed due to the vendor taking his own sweet time to attend you or the pricing is higher than it is worth?

In today's rapidly developing world of subscription business, storing, accessing and maintaining 'BIG DATA' is a task in itself.

A loyal and retained customer will act as an ambassador of your brand and product, and provide recurring cash flow to your business. Bringing New customers is not only an effort taking but promising job as well. It is not about selling a product, it is about gaining customers. When the matured customers are happy, it’s easier to attract new ones.

Since 2021, MYFUNDBOX a bootstrapped Start-up, has been offering a Subscription Billing Platform for all business that rely on recurring payments and Subscriptions.

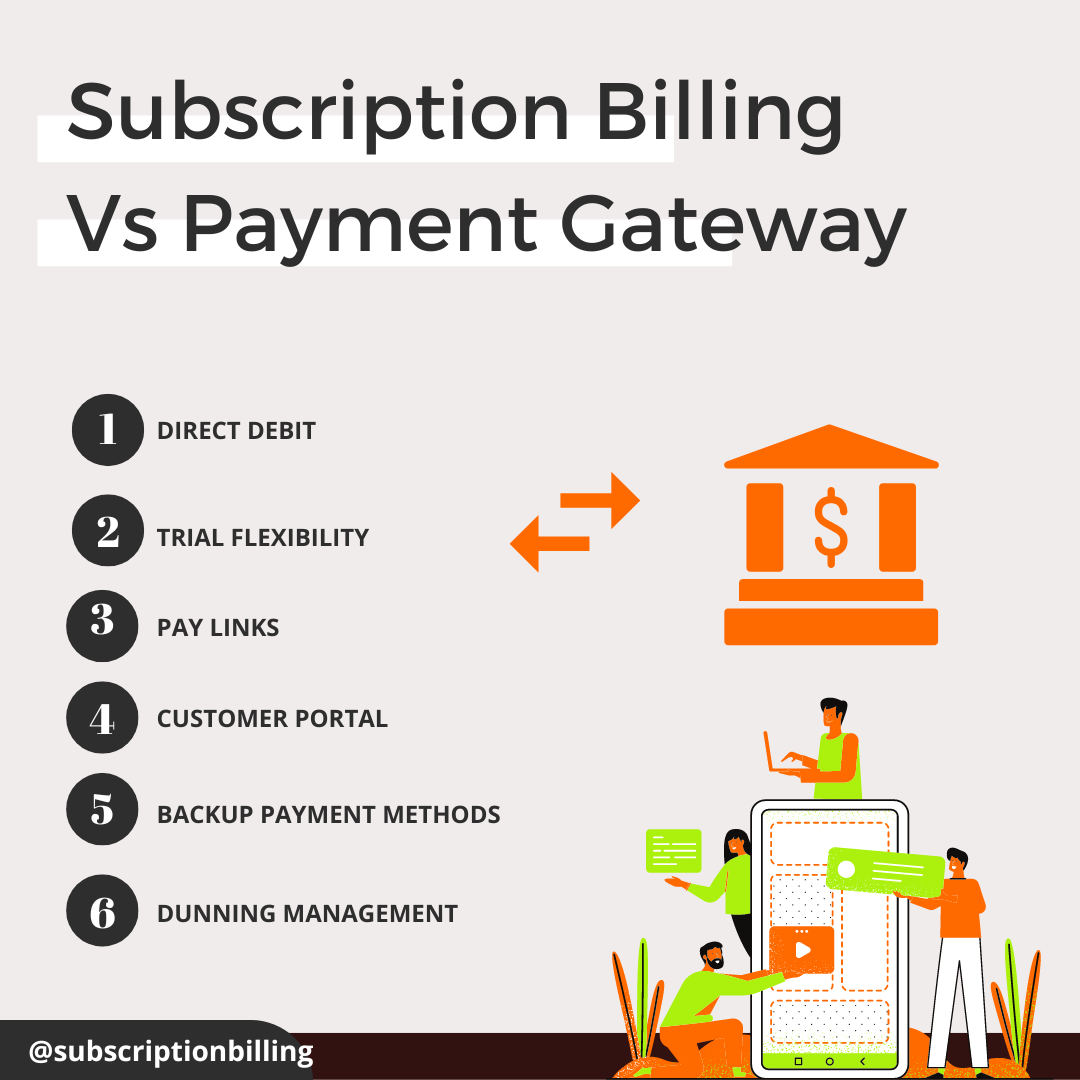

when it comes to a choice between a #subscriptionbilling platform and a #paymentgateway. Customer experience is of foremost importance for any business, and this only gets amplified for a SaaS or subscription business, where concerns like #churn and #customerretention take the foreground.

Does your checkout need a checkup? For nearly all ecommerce businesses, the answer is an emphatic yes, according to MYFUNDBOX Subscription Billing’s global payments platform, Stripe. In a recent study that surveyed leading B2B and B2C ecommerce sites and customers, Stripe discovered that 96% of sites in North America, as well as 95% in Asia-Pacific and 94% in Europe, had at least five basic errors in their checkouts. The problem not only spans regions, but also organizations of all sizes, from startups to large, established ecommerce sites with teams focused on increasing conversions.

The trend toward #subscription-based business is clear: by 2023, 75% of direct-to-consumer #ecommerce brands are expected to adopt a subscription model.

Adopting a subscription-based model is a proven way for ecommerce businesses to capture more repeat business, add new revenue streams, and grow their market share.

To keep your business running smoothly and provide optimal experiences to your customers, you need a way to send invoices and collect payments that won’t frustrate them—or you. That’s especially true if they’re among the 40% of companies that still mail paper checks, creating more manual work for your customers and slowing down the process.

As more and more enterprise businesses move toward a SaaS or recurring service model, they need a billing solution that can manage recurring invoices and payments. But that’s not all—they also need a solution that can save time and resources, reduce accounting and reporting errors, and handle compliance and tax across multiple markets as the business grows.