MYFUNDBOX and Stripe help more online businesses get paid and fight fraud

As more businesses move and transact online, we're continuously expanding our own solutions to make it simpler for our customers to start, run, and scale their businesses.

Posts about:

As more businesses move and transact online, we're continuously expanding our own solutions to make it simpler for our customers to start, run, and scale their businesses.

With the rapid growth of online retail sales worldwide, a casual observer might understandably believe that the future of commerce is online. In fact, the future of commerce is omnichannel—blending online and offline modalities for a seamless shopping experience that allows customers to engage with your brand in person, on their mobile devices, or wherever and however they please.

Rapid growth in ecommerce sales and digital adoption across the globe opens up a world of opportunity for businesses looking to expand. The numbers alone make a compelling case: in 2021, ecommerce sales are expected to make up nearly 20% of total retail volume.1 By 2023, global ecommerce is projected to hit $6.5 trillion2 with the majority of retail ecommerce growth occurring in Latin America, Central and Eastern Europe, and the Middle East and Africa.3

A huge shift to online commerce is underway, with ecommerce growing 30% a year globally.1 This massive shift in consumer behaviour makes it an exciting time to be doing business online, but it also brings some challenges. One of those is failed payments, also known as “network declines.”

Ecommerce is growing rapidly. While that presents an immense opportunity for online retailers, it also brings some challenges. As online shopping becomes ubiquitous, fraudsters have evolved to become more sophisticated, and fraudulent payments are a growing problem. In fact, businesses are expected to lose $20 billion to online fraud in 20211.

While the average human life span has increased in recent decades, the average business isn’t faring as well. S&P 500 companies in the ’60s and ’70s could count on three good decades of livelihood, but that life span has been steadily dropping—expected to shorten1 to 15–20 years during this decade. The small business owner faces even more dire statistics, with only 50 percent2 of small businesses surviving past year five.

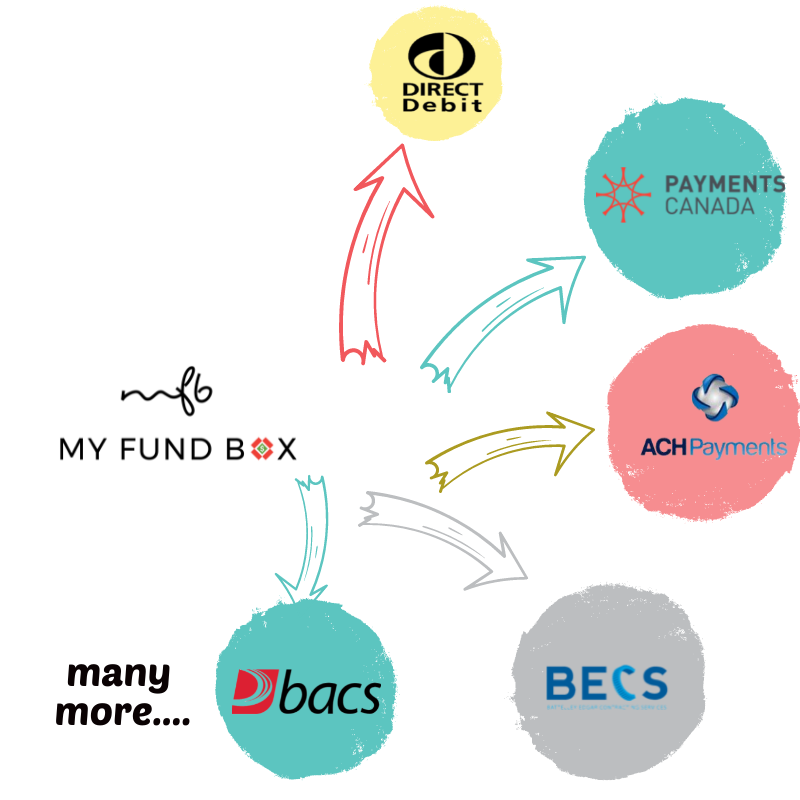

MYFUNDBOX is a Global Subscription Billing Platform where one can process, manage and accept subscription billing for SaaS Companies, Freelancers, Coaches and all type of businesses that need recurring payments. With flexibility to create custom billing cycles and configurable customer preferred payment methods customer conversion increases substantially.

I could seldom imagine myself accepting the fact that education could be done online some twenty years ago. Now Iam still trying to accept the fact that my kids take music classes online. Learning how to play the piano online. Really?

.png)

We’re thrilled to share that MYFUNDBOX Subscription Billing has been named as High Performer in the G2 Winter 2022 Grid Reports. G2 is a leading peer-to-peer review site that provides unbiased user reviews on leading software solutions. Quarterly, G2 highlights the top-rated solutions in the industry, as chosen by customer reviews.